Spread Of Finance . A spread in trading is calculated as the difference between the bid and ask price for a financial asset, whether this be a currency pair, index or. The spread is a key part of cfd trading,. Spread is the price, interest rate, or yield differentials of stocks, bonds, futures contracts, options, and currency pairs of related. A spread in trading is the difference between the buy ( offer) and sell ( bid) prices quoted for an asset. The spread in forex is a small cost built into the buy (bid) and sell (ask) price of every currency pair trade. When you look at the price. A spread option is a type of option contract that derives its value from the difference, or spread, between the prices of two or more. Discover the meaning of spread in financial markets and how it impacts trading.

from www.financestrategists.com

Discover the meaning of spread in financial markets and how it impacts trading. The spread in forex is a small cost built into the buy (bid) and sell (ask) price of every currency pair trade. Spread is the price, interest rate, or yield differentials of stocks, bonds, futures contracts, options, and currency pairs of related. A spread in trading is the difference between the buy ( offer) and sell ( bid) prices quoted for an asset. When you look at the price. A spread in trading is calculated as the difference between the bid and ask price for a financial asset, whether this be a currency pair, index or. A spread option is a type of option contract that derives its value from the difference, or spread, between the prices of two or more. The spread is a key part of cfd trading,.

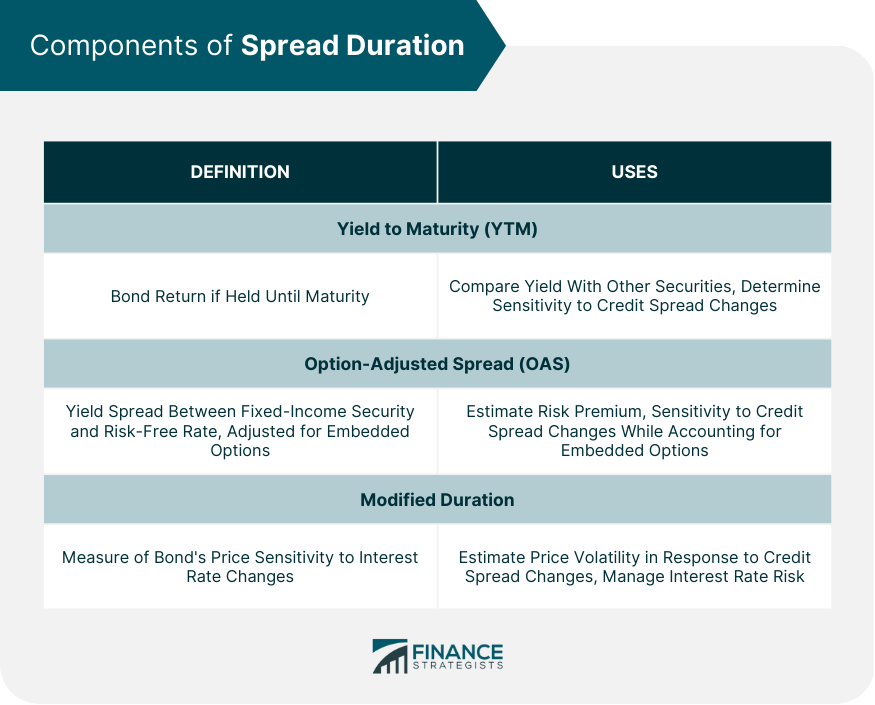

Spread Duration Definition, Components, & Applications

Spread Of Finance Spread is the price, interest rate, or yield differentials of stocks, bonds, futures contracts, options, and currency pairs of related. The spread is a key part of cfd trading,. A spread option is a type of option contract that derives its value from the difference, or spread, between the prices of two or more. Discover the meaning of spread in financial markets and how it impacts trading. A spread in trading is calculated as the difference between the bid and ask price for a financial asset, whether this be a currency pair, index or. Spread is the price, interest rate, or yield differentials of stocks, bonds, futures contracts, options, and currency pairs of related. A spread in trading is the difference between the buy ( offer) and sell ( bid) prices quoted for an asset. The spread in forex is a small cost built into the buy (bid) and sell (ask) price of every currency pair trade. When you look at the price.

From www.besmartee.com

How Financial Spreading Automation Significantly Reduces Operational Spread Of Finance Discover the meaning of spread in financial markets and how it impacts trading. When you look at the price. A spread option is a type of option contract that derives its value from the difference, or spread, between the prices of two or more. The spread in forex is a small cost built into the buy (bid) and sell (ask). Spread Of Finance.

From analystprep.com

Using Futures for Hedging AnalystPrep FRM Part 1 Study Notes Spread Of Finance A spread in trading is the difference between the buy ( offer) and sell ( bid) prices quoted for an asset. The spread is a key part of cfd trading,. Discover the meaning of spread in financial markets and how it impacts trading. A spread in trading is calculated as the difference between the bid and ask price for a. Spread Of Finance.

From fabalabse.com

What does credit spread indicate? Leia aqui What do high credit Spread Of Finance A spread in trading is the difference between the buy ( offer) and sell ( bid) prices quoted for an asset. When you look at the price. A spread in trading is calculated as the difference between the bid and ask price for a financial asset, whether this be a currency pair, index or. The spread is a key part. Spread Of Finance.

From www.projectfinance.com

The BidAsk Spread Explained Options Trading 101 projectfinance Spread Of Finance The spread in forex is a small cost built into the buy (bid) and sell (ask) price of every currency pair trade. Spread is the price, interest rate, or yield differentials of stocks, bonds, futures contracts, options, and currency pairs of related. When you look at the price. A spread in trading is the difference between the buy ( offer). Spread Of Finance.

From fabalabse.com

What happens to credit spreads when rates rise? Leia aqui Do credit Spread Of Finance Discover the meaning of spread in financial markets and how it impacts trading. A spread option is a type of option contract that derives its value from the difference, or spread, between the prices of two or more. A spread in trading is calculated as the difference between the bid and ask price for a financial asset, whether this be. Spread Of Finance.

From www.investopedia.com

Spreads in Finance The Multiple Meanings in Trading Explained Spread Of Finance Spread is the price, interest rate, or yield differentials of stocks, bonds, futures contracts, options, and currency pairs of related. The spread is a key part of cfd trading,. A spread in trading is calculated as the difference between the bid and ask price for a financial asset, whether this be a currency pair, index or. Discover the meaning of. Spread Of Finance.

From fabalabse.com

What are the 7 sources of finance? Leia aqui What are the 7 sources of Spread Of Finance Discover the meaning of spread in financial markets and how it impacts trading. When you look at the price. Spread is the price, interest rate, or yield differentials of stocks, bonds, futures contracts, options, and currency pairs of related. A spread option is a type of option contract that derives its value from the difference, or spread, between the prices. Spread Of Finance.

From thefragmentedmuseum.com

Personal Finance and Investing thefragmentedmuseum Spread Of Finance Spread is the price, interest rate, or yield differentials of stocks, bonds, futures contracts, options, and currency pairs of related. A spread in trading is calculated as the difference between the bid and ask price for a financial asset, whether this be a currency pair, index or. The spread in forex is a small cost built into the buy (bid). Spread Of Finance.

From www.youtube.com

What is the 'Spread' in Finance? YouTube Spread Of Finance When you look at the price. A spread option is a type of option contract that derives its value from the difference, or spread, between the prices of two or more. Discover the meaning of spread in financial markets and how it impacts trading. A spread in trading is calculated as the difference between the bid and ask price for. Spread Of Finance.

From tiblio.com

Credit Spread Finance Explained Spread Of Finance The spread is a key part of cfd trading,. A spread in trading is the difference between the buy ( offer) and sell ( bid) prices quoted for an asset. A spread option is a type of option contract that derives its value from the difference, or spread, between the prices of two or more. The spread in forex is. Spread Of Finance.

From db-excel.com

Financial Spreadsheets Finance Xls in Spreadsheet Free Tax Templates Spread Of Finance When you look at the price. Spread is the price, interest rate, or yield differentials of stocks, bonds, futures contracts, options, and currency pairs of related. The spread is a key part of cfd trading,. The spread in forex is a small cost built into the buy (bid) and sell (ask) price of every currency pair trade. A spread option. Spread Of Finance.

From www.slideshare.net

Advantages Of Financial Spread Betting Spread Of Finance The spread in forex is a small cost built into the buy (bid) and sell (ask) price of every currency pair trade. Discover the meaning of spread in financial markets and how it impacts trading. The spread is a key part of cfd trading,. A spread in trading is calculated as the difference between the bid and ask price for. Spread Of Finance.

From excelxo.com

business finance spreadsheet template — Spread Of Finance The spread in forex is a small cost built into the buy (bid) and sell (ask) price of every currency pair trade. A spread in trading is calculated as the difference between the bid and ask price for a financial asset, whether this be a currency pair, index or. When you look at the price. Spread is the price, interest. Spread Of Finance.

From www.pinterest.jp

Pin on Saving money budget Spread Of Finance A spread option is a type of option contract that derives its value from the difference, or spread, between the prices of two or more. The spread is a key part of cfd trading,. Discover the meaning of spread in financial markets and how it impacts trading. A spread in trading is the difference between the buy ( offer) and. Spread Of Finance.

From www.financestrategists.com

Spread Duration Definition, Components, & Applications Spread Of Finance Spread is the price, interest rate, or yield differentials of stocks, bonds, futures contracts, options, and currency pairs of related. Discover the meaning of spread in financial markets and how it impacts trading. A spread in trading is the difference between the buy ( offer) and sell ( bid) prices quoted for an asset. The spread is a key part. Spread Of Finance.

From www.businesser.net

Finance Spreadsheet Example businesser Spread Of Finance Spread is the price, interest rate, or yield differentials of stocks, bonds, futures contracts, options, and currency pairs of related. Discover the meaning of spread in financial markets and how it impacts trading. When you look at the price. A spread in trading is calculated as the difference between the bid and ask price for a financial asset, whether this. Spread Of Finance.

From db-excel.com

Financial Spreadsheet Example within Financial Spreadsheet Template Spread Of Finance A spread option is a type of option contract that derives its value from the difference, or spread, between the prices of two or more. A spread in trading is the difference between the buy ( offer) and sell ( bid) prices quoted for an asset. The spread in forex is a small cost built into the buy (bid) and. Spread Of Finance.

From seekingalpha.com

Stock Market Warning Credit Spreads Are Widening Again Seeking Alpha Spread Of Finance The spread in forex is a small cost built into the buy (bid) and sell (ask) price of every currency pair trade. Spread is the price, interest rate, or yield differentials of stocks, bonds, futures contracts, options, and currency pairs of related. A spread option is a type of option contract that derives its value from the difference, or spread,. Spread Of Finance.